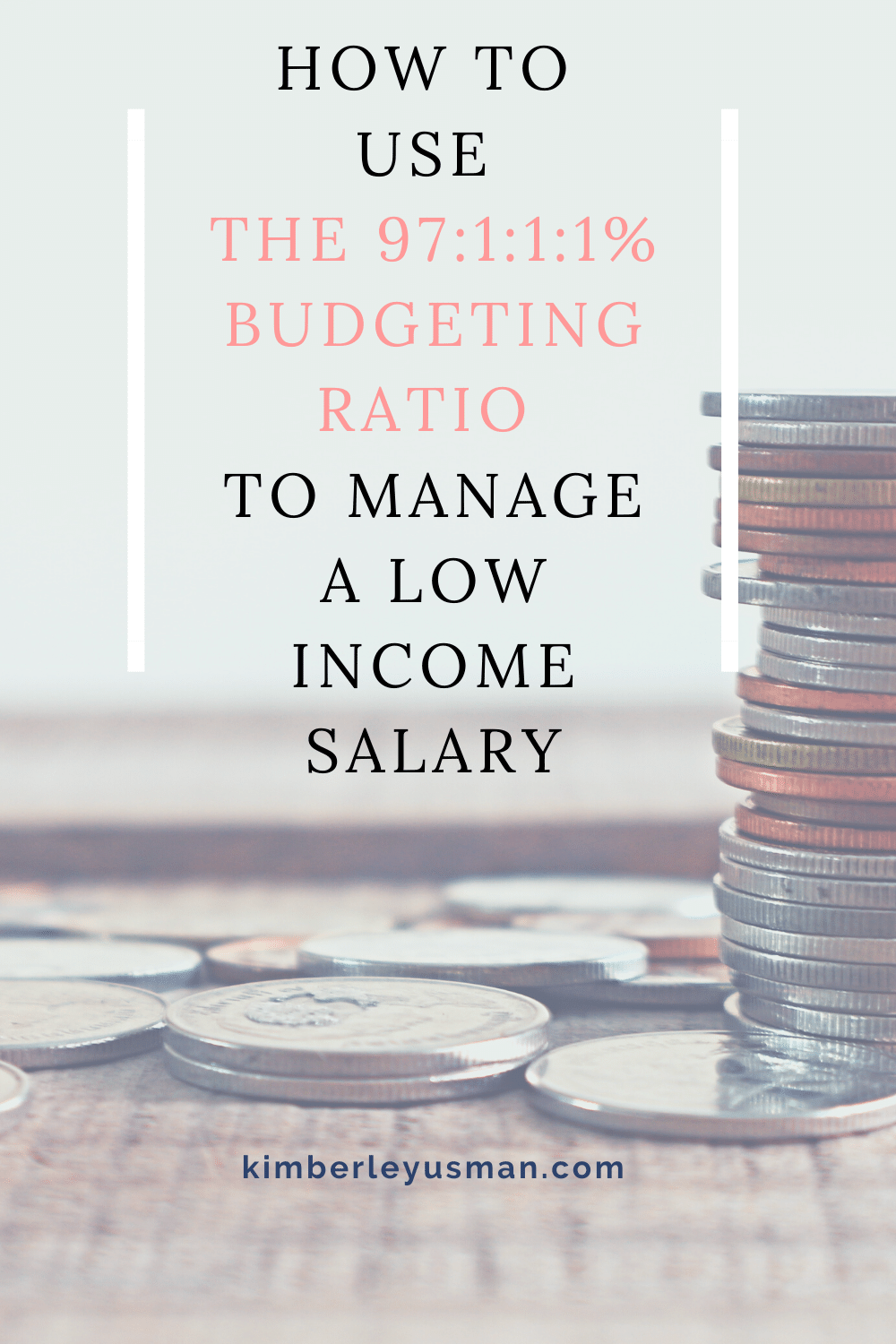

A beginner’s guide to using a simple budgeting ratio to divide and allocate your Paycheck the Right way.

The number one hurdle that beginners experience when trying to budget is knowing exactly how to divide and allocate their paycheck the right way.

Budgeting ratios will end your confusion about what to do with your money to build wealth. Then you can move on to simply growing your income so that you can have more freedom to do all the things you want.

The 97:1:1:1% Budgeting Ratio is a perfect starting point for anyone:

- Living Paycheck to Paycheck

- Earning a low income and looking to grow their wealth

- New to budgeting and wants to dive in slowly

- Feeling too overwhelmed by their expenses to make room for saving.

The 97:1:1:1% Budgeting Ratio is also not the only ratio you can use. If you earn a high salary, you might find that the 70:10:10:10% Budgeting ratio following the same formula works better for you.

Here is the formula break apart

Disclaimer: I am NOT a Financial Advisor, Planner, or Counselor. Hence, the information presented here is NOT professional advice. It is my own opinion and exists only for educational and informational purposes.

97% of your paycheck goes toward your Expenses

Let us say you make $1000 per month.

According to the 97:1:1:1% budgeting ratio, you should be setting aside 97% of that $1000 for covering all monthly expenses.

That is $970 to cover:

- Rent

- Bills

- Groceries

- Pet supplies

- Plus any other month-to-month expenses you have.

1% goes toward an investment in your future.

Of the 3% salary you have remaining, 1% should be put aside or used for something that will be profitable to you in the long run.

Using the example of $1000, that’s $10 towards:

- Starting a business

- Your education

- Purchasing stocks to grow wealth over time

- Any other long-term rewarding goal that you have

$10 may not sound like it can help with any of the suggestions above. But, I promise you that putting it aside in an envelope each time you get paid will add up over time. And that’s when it will come in handy for that investment you want to make.

1% for your Savings

Here is another $10 that you can actively put aside to growing your emergency fund.

If you are already familiar with *Dave Ramsey’s 7 Baby Steps*, you will know that Building a $1000 baby emergency fund is the first step to growing financial wealth.

An emergency fund comes in handy when life decides to throw a financial curveball at you. Such as your pet falling sick, your car breaking down, etc.

Saving nothing from your paycheck is not allowed. But putting aside $10 every time you get paid will eventually get you to that $1000 that comes in handy for any unexpected financial crisis.

1% to Give/ Debt

Making room for giving should always be a part of your budget.

You might find that this $10 comes in handy for purchasing gifts or a small birthday party that you might want to keep for your kids.

However, if you are someone in debt, putting this extra $10 towards paying off your debt is more important to help you take back control of your finance.

Debt is originally an expense and should be coming out of the 97% we discussed at first. But the sooner you can pay off your debt, the sooner you will be on your way to achieving financial independence.

Plus, when it comes to gifts, you can always get creative and make simple DIY Gifts or write a card which is, in my opinion, always more valuable than the actual gift.

To recap, the 97:1:1:1% Budgeting Ratio means:

- 97% of your paycheck goes toward all monthly expenses

- 1% for investing in your future

- 1% goes to your savings

- 1% to use for giving or paying off more of your debt.

Remember, anyone with a high salary that can dedicate less than 97% of income towards expenses should use the 70:10:10:10% Budgeting Ratio instead.

A lower percentage towards expense means more room to save, invest, give or pay off debt.

If you found this helpful, remember to pin it so that you can refer to it later and leave a comment letting me what else you would like to see.

Thank you!

Pin me ↓

Here's more

9 Tips to Get Your Life Together

To get your life together is to be your own parent. As you grow older, you might realize that there are many parts of your life that need change. You are no longer the careless youth you were. For me it happened as I got closer to entering my late twenties. I was so...

How to Create Simple and Successful Morning Routine

A Morning Routine is a set of habits you go through when you wake up to prepare you for taking on the day. But do you know that a successful morning routine starts the night before? It starts by going to bed mentally ready to take on the next day. Your actions in the...

Creating Routines around Irregular Work Hours

Routines are essential for achieving maximum productivity and unlocking bits of freedom in your day-to-day life. This means finally being able to work on your long-term goals with more consistency. Routines help you to know what to do and when to do it. But producing...